OSLA Student Loan Login Online Repayment & Oklahoma Student Loan Authority

If you have a federal student loan, Osla Student Loan Login is the best choice for you. If this company is servicing your federal loans, our OSLA Servicing Caculator can help you find out all you need to know.

About OSLA

OSLA was created in 1972 to assist student loans in Oklahoma. However, over time, OSLA has become a general federal student loan servicer that you can use as your servicer even if you don’t live in Oklahoma.

Office of Legal Aid Student Loan Services, such as Office of Legal Aid, manage the paperwork and planning that come with federal student loan onsolidation. Basically, the government outsourced student loan management to a service that helped borrowers log in to manage their loans and collect payments through OSLA.

In addition to securing your loan payments plan, you’ll want to contact your school loan servicer for help:

- Income-driven repayment plans

- Deferment and forbearance

- Student loan forgiveness

- Student loan disbursement

Loan services

Student loan servicers are responsible for collecting and managing your student loan payments. If you have federal student loans, the U.S. Department of Education assigns you a student loan servicer when you make your student loan payments to college or graduate school.

A study loan may be different from your lender. To be received loan authority from a lender, but you pay a federal home education loan, which can help you pay your ffel plan loan, but they don’t necessarily act as your financial advisor.

That’s why it’s important to understand all of your federal program options, because your student loan debt may be in their own best interest, not yours.

Benefits

- If you had a loan issued under the now-canceled FFEL program, or if you had a renewed Federal Student Direct Loan, you can now log in to Private Student Loans.

- Check to see if your service provider is OSLA (or another company) by visiting the National Student Loan Data System (NSLDS). From there, you’ll be able to see all the loans listed with your service.

similar content: https://seattleducation.com/national-student-loan-login/

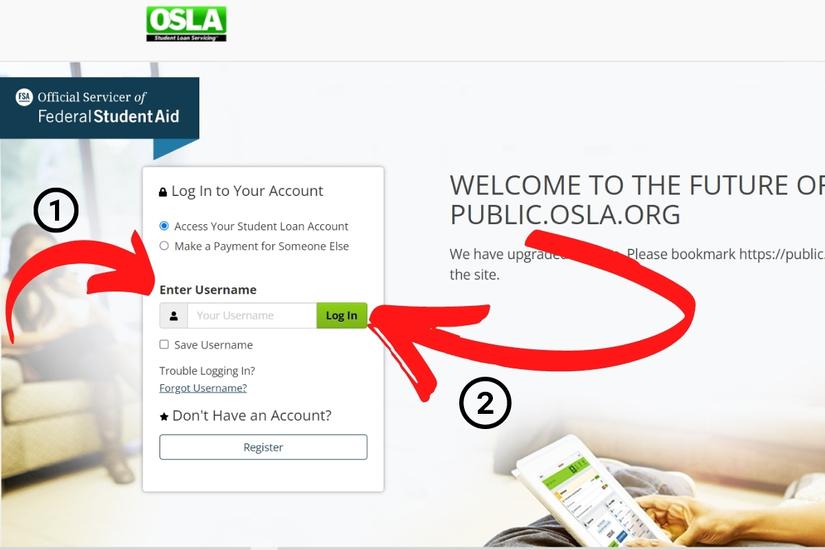

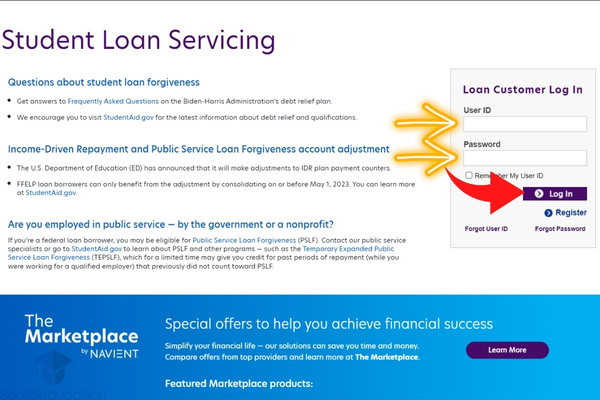

OSLA Student Loan Login To Online Account

- Visit the official website via the link: https://secure.osla.myloanmanager.com/

- Enter your username into the blank field as shown

- Select “Login” to finish

Note: You can save the next automatic login by ticking the “Save Username” box.

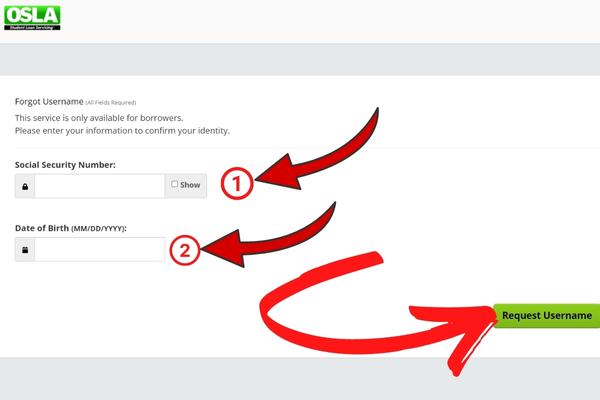

Restore Username

If you are having trouble logging in, you can use the steps listed below to obtain your user ID:

- Select the text with the “Forgot Username?” link in the account login area

- Please enter your variable information to confirm your identity, including your social security number and date of birth (MM/DD/YYYY)

- Select “Request Username” and follow the next steps as instructed by the system

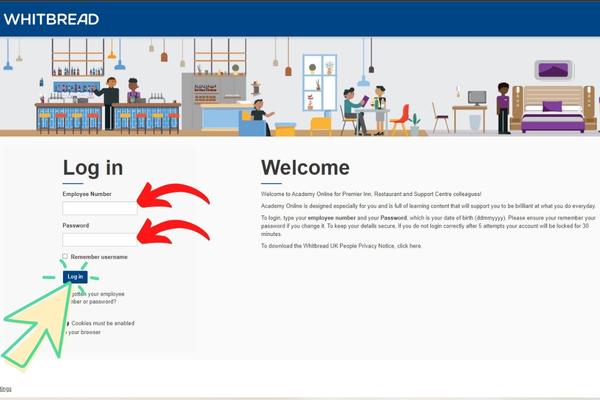

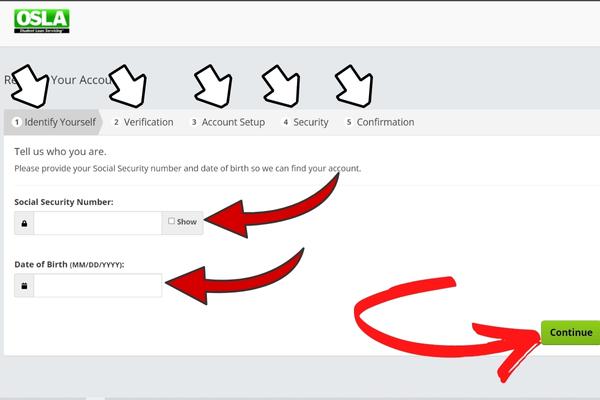

How to sign up for borrower

- Click “Register” to create an account on OSLA wesite

- Please provide 5-step identity information: authentication, verification, account setup, security, confirmation. To go to the next step, click “Continue“

- Complete the necessary steps until the OSLA account registration is successful

How long does it take to repay an OSLA student loan account?

Whether you earn a degree or not, it is very important to OSLA’s lenders that you pay back your loans on time. However, make payments grace period depends on the student loan repayment options method you choose. OSLA offers about four options, as follows:

- Standard: This is the basic 10-year repayment plan with automatic payments set up

- Graduation: The initial payment is lower but increases over time.

- Deferment: You must still owe more than $30,000 on your FFEL or Direct Loan.

- IBR (Income Based Repayment): Loans are forgiven after 20 or 25 years.

- Income Contingent Repayment (ICR): Your loan is forgiven after 25 years.

- Pay As You Earn (PAYE): Receive Direct Loan Payments

- REPAYE (Revised Pay As You Earn): Except there are no restrictions on when you can borrow money.

Refinancing Student Loans

You can refinance your OSLA loan by applying for a new lenders from a private lender to pay off your current debt. If you are unhappy with legal aid, student loan refinancing is one of two ways you can switch loan servicers.

It might not be the best choice for you, though. That’s because you’ll lose several important benefits of federal loans. Includes low interest rates, flexible repayment schedule, and eligibility for certain forgiveness programs.

read more: Discover Student Loans Login Online Account & Discover Credit Card

Student loan interest rate and Fees

All federal OSLA student loan servicing fees and lower interest rates are set by Congress. They change regularly, and every year you’ll have new fees and rates. You can find out what your current lowest interest rate is by logging into your account with OSLA and reviewing your loan listings, or using NSLDS to view your loan balance and their terms.

What are my options for paying my legal aid bill?

By email:

U.S. Department of Education – OSLA

PO Box 4278

Portland, OR 97208-4278

Via online payment form:

You can also choose to pay your monthly payments bill online. OLA offers several online bill payment options. This means you can transfer money or pay with your MasterCard or Visa ATM card from the comfort of your own home. Doxo.com is one of these online stores, or you can fill out the Ez authorization form.

Avoid Common Problems When Borrowing with OLA

As of January 2019, OLA has received relatively few complaints compared to other Commonwealth new one loan complaints online. Only 27 customers filed complaints with the Consumer Financial Protection Bureau (CFPB).

In terms of quality of service, OSLA rarely publishes complaints. Honestly, this is refreshing since many services have hundreds of complaints online.

From one perspective, most service providers have hundreds or thousands of complaints. It also has an A+ rating from the Better Business Bureau (BBB) based on factors such as hours of operation and transparency. There are two types of federal loan servicers:

1. Improper handling of refunds

Some clients have complained to the CFPB that the Office of Legal Aid mishandled their licensed financial professionals before making any financial products.

Borrowers tried to repay one of the loans, but ended up spreading more federal student loan borrowers.

Details of similar complaints are not trusted by the public:

‣ How to Avoid: Because OSLA website doesn’t provide much information on how to pay off your loan or make financial decisions, sell insurance, etc. Therefore, please contact Customer Service for specific instructions.

‣ Check your account after payment to make sure they are applied the way you expect them to be, and get in touch if you notice any issues.

2. Incorrect information reported to credit bureaus

Some borrowers have complained that OLA misreported information to credit bureaus, affecting their credit scores.

One borrower said that OLA reported their loan as delinquent when it encountered deferral issues. Account information on similar claims is also inaccessible to the public.

‣ How to avoid it: Monitor your accounts even if your loan is being modified.

And get in the habit of checking your credit report regularly. Also open, make sure your creditors aren’t misreporting your returns. If you find an error, contact Legal Aid and ask them to fix the problem.

How to Contact OSLA Customer Service

You can contact Cornerstone Customer Service in the following ways:

- Phone Number: (866) 264-9762

- Hours of operation: 8-5. Monday-Friday (Connecticut)

- Email/online contact form: [email protected]

- General mailing address:

U.S. Department of Education – OSLA

P.O. Box 4278

Portland, OR 97208-4278

- OSLA Mailing Address For General Correspondence:

Oklahoma Student Loan Authority

P.O. Box 18475

Oklahoma City, OK 73154-0475

FAQs

Need more information about college loans? Please contact us through email, social media, or leave a comment. Remember to follow us on Seattleducation to read and learn more about digital banking.