National Student Loan Login Loan Repayment | Federal Student Loan

National Student Loan Login to check the latest information on your repayment terms. If you want to further eligibility through the new zero income threshold and the maximum payment has been reduced from 20% of household income to 10%.

Overview National Student Loan Data System

The National Student Loan Data System (NSLDS) is the U.S. Department of Education (ED) central database for Federal Student Aid. NSLDS receives data from schools, guarantor agencies, direct loan programs, and other ED programs. NSLDS Student Access provides a centralized, integrated view of Title IV loans and grants so that recipients of Title IV aid can access and query their Title IV loan and/or grant data.

Loans and grants listed on the NSLDS website have been reported from a variety of sources. Generally, funding agencies are responsible for reporting aid information to NSLDS.

Direct loans are reported by the direct loan servicer, Federal Home Education Loan Program loans are reported by their guarantors, Perkins loans are reported by the school (or its agent), and grants are reported by the U.S. Department of Education Joint Origination and Payment System.

Loan service providers can often provide more information about current balances and loan status than is available in databases, which may or may not be outdated.

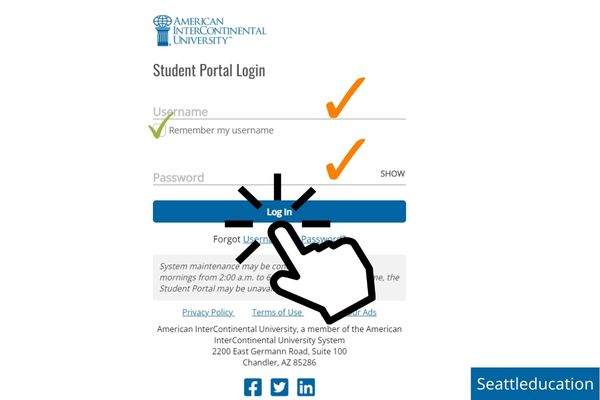

New post on Seattleducation:

>> Time4learning Student Login, Password Recovery & Customer Service

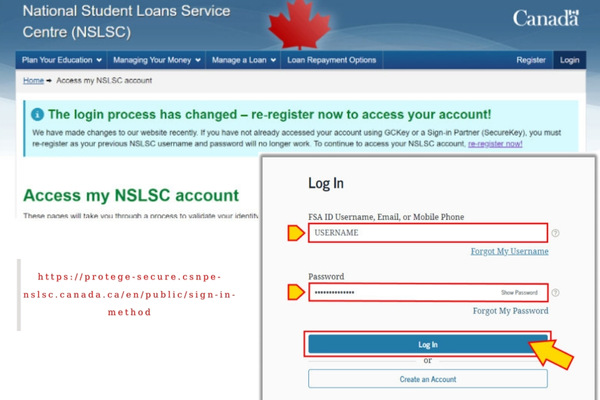

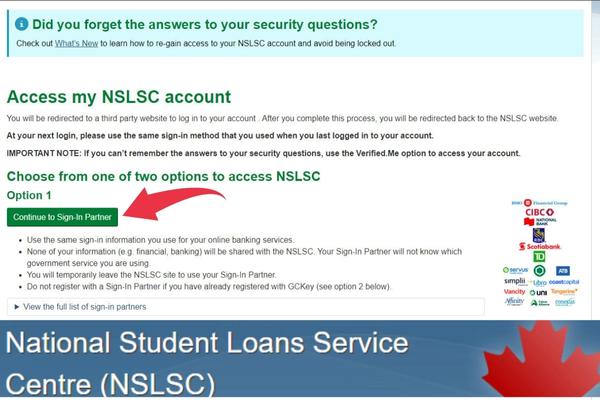

National Student Loans Service Centre Login

You will be redirected to a third-party website to log into your account. After completing this process, you will be redirected back to the NSLSC website. The next time you log in, please use the same login method you used to log in to your account last time.

Important: If you don’t remember the answers to your security questions, use the Verified.Me option to access your account.

Option 1: Continue to Sign-In Partner

- Use the same login information you use for online banking.

- None of your information (e.g. financial, banking) will be shared with NSLSC. Your login partner will not know which government service you are using.

- You are temporarily leaving the NSLSC’s site to use your login partner.

- If you are already registered with a GCKey, please do not register a login partner (see option 2 below).

Summary of the full list of sign-in partners

- Affinity Credit Union

- Alberta Treasury Branches

- BMO Financial Group

- CIBC Canadian Imperial Bank of Commerce

- Coast Capital Savings

- Conexus Credit Union

- Desjardins Group

- Libro Credit Union

- National Bank of Canada

- RBC Royal Bank

- Scotiabank

- Servus Credit Union

- Simplii Financial

- Tangerine

- TD Bank Group

- Vancity

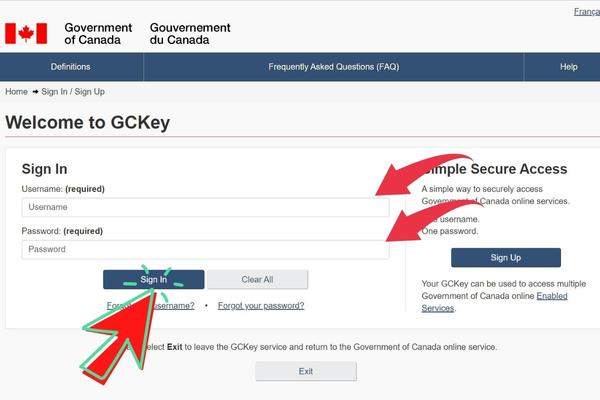

Option 2: Continue to GCKey

- Log in to your secure NSLSC account using your existing GCKey username and password.

- If you have forgotten your existing username and password or don’t have one, please register for a GCKey account information.

- Do not register a GCKey username if you are already enrolled with a login partner (see option 1 above).

How to log in to the NSLDS data system for Student

- You will need your assigned PIN to log in.

- Log in to the NSLDS home page.

- Select the Financial Aid Review link.

- Type in the requested personally identifiable information.

- If you need assistance accessing the NSLDS website, please contact the Student Aid Information Center: at 1.800.4FED.AID.

If you are accessing the NSLDS data system in preparation for repayment, please read the following conditions and terms information carefully.

The NSLDS website summarizes federal financial aid awarded to students. For repayment purposes, only student loan and financial aid programs have a repayment obligation (either monetary or through service credit). For more information on repayment terms, see the Student Loan Promissory Note (the lender can provide you with a copy if you don’t have one) or the Teach Grant Agreement to Serve.

The NSLDS website does not aggregate non-federal debt and the Non-Federal Agency (Campus) Loans – Cal Poly is a lender to all of the following loan types:

- Collins

- Lydia Humphrey

- long term ruze

- Nissen

- from Asperon

- CFFA

- Dugan

- Camp

- Noyce Faculty Scholarships and Grants

- …and any other institutional loan through Cal Poly

- Non-Federal Alternative Student Loans (loans by banks)

- Unpaid Caltech Student Account Debt

How to Find Out If You Have Non-Federal Debt

- Private Alternative Student Loans Through Banks: Contact the Financial Aid Office and make inquiries.

- Institutional Loans (including Noyce Scholarships/Grants) through Cal Poly: Contact your Cal Poly Repayment Advisor and ask (please include the last 4 digits of ID#)

- Unpaid Caltech Student Account Debt: Access your Student Center page through the portal (check your holdings carefully)

Note: Students can access the portal for 2 years after their final semester at Cal Poly. Due to miscellaneous charges that may be charged to the student account after a student leaves, we strongly recommend that all students leaving Caltech check the Student Center page once or twice a month for at least 3 or 4 months (both the Retention and Finance sections are available ) on the Student Center page (via the Money Issues tab).

If you have any difficulties logging into the portal, please contact the Cal Poly Help Desk (8:00 am – 5:00 pm): 805-756-7000.

National Student Loans forgiveness program in 2022

In the United States, higher education is becoming more and more expensive, so more and more students are forced to take out loans to pay for their education. Unfortunately, many of these students were unable to repay their loans after graduation so National Student Loan Forgiveness programs were born and developed.

The National Student Loan Forgiveness Program is a federal student loan forgiveness program for qualified borrowers. So how does it work?

This helpful program allows eligible borrowers to have their federal student loans forgiven after making 120 qualifying payments, however borrowers must be enrolled in a plan. income-based repayment plan.

In addition, the debtor must work full-time (30 hours or more per week) in a public service job or in a job that has been designated by their employer but must still ensure that the requirements are met. study results if still in school.

And you must have Direct Loans, if you do your research you will know this is North America’s most popular, well known and preferred type of federal student loan.

Please note that in order to benefit from this program, you must have a detailed, clear repayment plan and reasonable schedule. It includes:

- Income-based plans.

- Contingency Income Plan (ICR).

- Income-Based Repayment Plan (IBR) or As You Earn (PAYE) Repayment Plan.

National’s student loan center call at www.nslds.ed.gov

By Phone

- Their agents are available to assist you over the phone Monday to Friday, from 8:00 am – 8:00 pm, your local time at 1-888-815-4514

- Outside of North America, you can dial: 800-2-225-2501

- TTY: 1-888-815-4556

Via MailBox

National Student Loans Service Centre

P.O. Box 4030

Mississauga ON, L5A 4M4

Send them an Email

Send them your request via email by filling out including the following information: First Name, Last Name,

Email Address, Telephone, and your Comments. They will respond within 2 business days.