AES Student Loan Login, Payment | American Education Services

American Education Services (AES student loan login) is a student loan servicer for both federal and private student loans. It also offers federal student loan consolidation and Student Loan Forgiveness programs. You can check your balance account, transaction history, new loan programs, and more.

What is American Education Service?

American Education Service, also known as AES, is a student loan service company that helps borrowers with their federal and private student loan borrowers. AES is one of the nine federally-recognized loan servicers and is owned by the Pennsylvania Higher Education Assistance Agency (PHEAA), a non-profit state agency.

It provides support to borrowers with their student loans, including helping them pay their debt and providing customer service for private companies and federal agencies such as FedLoan servicing.

If you have a student loan, you may be able to choose AES like a miracle because you can contact AES to find out more about their services and how they can help you with your student loan anytime and anywhere.

learn more: https://seattleducation.com/aviator-mastercard-login/

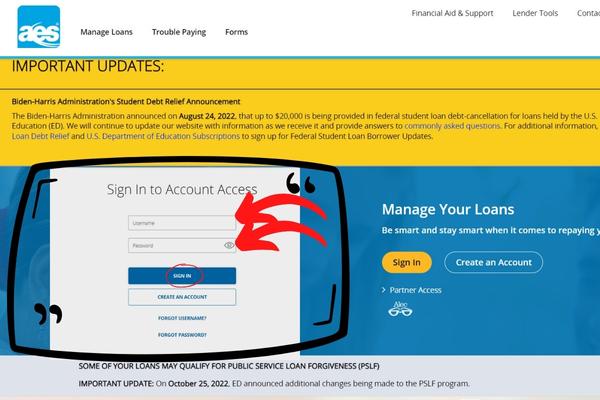

AES Education Student sign in online

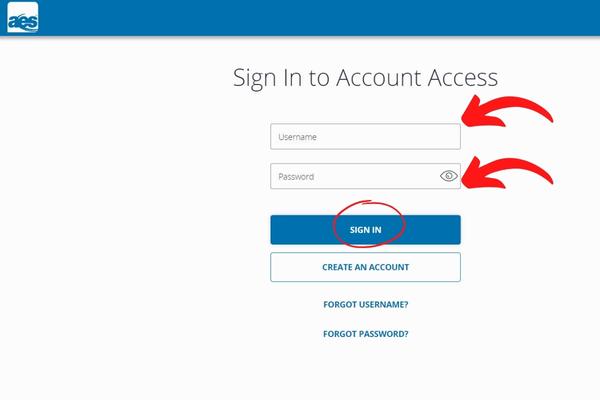

Using Browser Web

- Go to AES’s official website with link: https://access.aessuccess.org/ and click on “Sign In“

- Please enter Username and Password in the blank box as shown below

- Finally, select “SIGN IN ” to complete

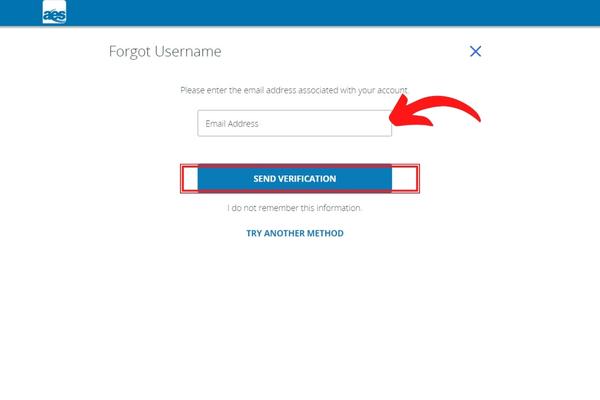

Reset Username

- Choose the text “Forgot Username?“

- You will be redirected to an interface, please enter your information to confirm your identity

- Click on “SEND VERIFICATION” state and wait for the system’s response in the following guided steps

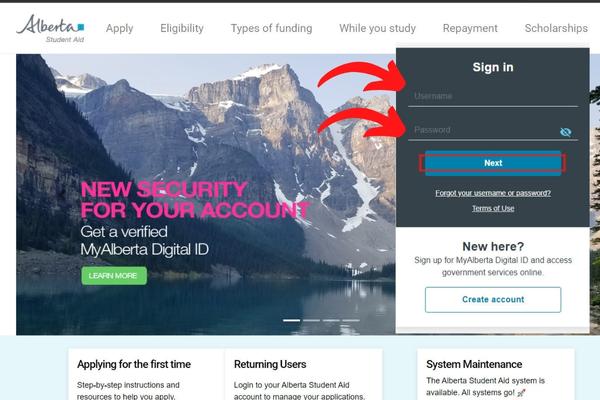

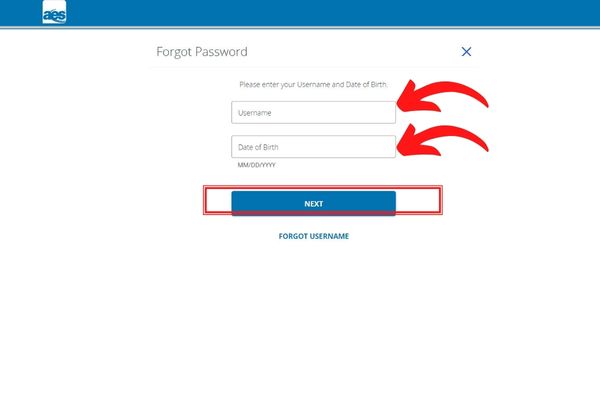

Reset Password

- Select “Forgot Password” inscription in your screen

- Fill in your UserID and Date of Birth

- Select “Next” and continue to follow the system instructions until done

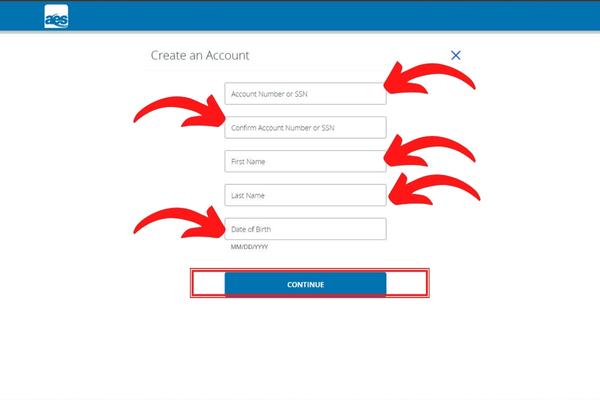

How to apply

- Select “CREATE AN ACCOUNT ” at the bottom of the account login box

- Please provide your Social Security number, First name, Last and date of birth in the blanks

- Follow all the instructions of the system and wait for their approval to be sent to you.

How to make American Education Services for student loan payments

It several ways for borrowers to make payments on their loans: online, by phone, by mobile app, by mail, or in person. You can also set up automatic payments through your bank or choose to make payments with a debit card. If you’re looking for a way to save on your loan payments, it offers a discount for borrowers with a 0.25% interest rate reduction for borrowers who enroll in their auto-debit program.

Direct Debit

Direct debit is electronic from your checking or savings account. Depending on your lender, you may be eligible for a monthly, bi-weekly, or even direct debit plan during the interest period, check account access to see your options today.

Benefit

- It is a convenient and hassle-free way to pay off your student loan payments.

- You may be eligible for a reduced interest rate while actively paying one-time.

- Since your loan payments happen automatically, as long as funds are available, there will be no delays.

- You can pay additional fees and provide us with instructions on how to allocate additional funds.

Pay Online

Advantages of paying online

- Pay anytime, anywhere, day or night

- arrange payment in advance

- Explain with any bank account you keep

- Additional Payments for Specific Loans

How to get started

- Log in to account access

- Click “Make a Payment“

- Enter payment information – you can save your bank’s account for future use

- Hit the “Make a Payment” button and use it for another month

Pay by Mobile App

Features of mobile payment

- Pay anytime, anywhere

- Additional funding for specific loans

- Have your routing number and account number ready to set up electronic payments

- Save your bank account for future payments or impact products

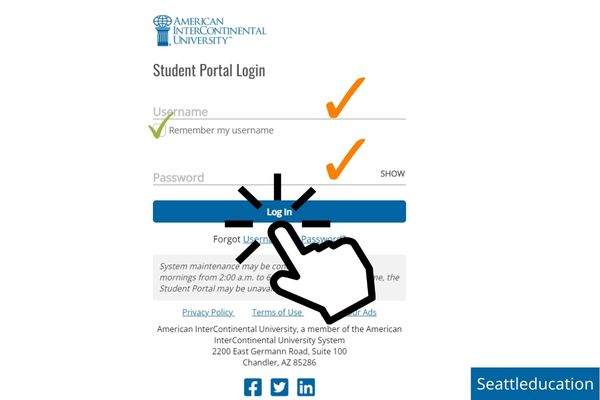

How to Get Started

- Download our mobile app at: Google Play or App Store

- Sign in account using your username and password

- Tap the “Payment” utility

- Choose your payment information on request

Pay by phone

- Call 1-800-233-0557 to pay anytime, day or night

- Arrange payment in advance

- Have your 10-digit account number and date of birth ready for identification

- Have your routing number and account number ready to set up electronic payments

- Save your bank account information for future payments

By Mailbox

American Education Services, 1200 N. 7th St., Harrisburg, PA

If you are a co-signer or verifier and be sure to focus your AES account number on the check. Only send payments to this address. Send any other correspondence to our mailing address.

Pay through a third-party bill payment service

If you use a bill pay service or pay through your portal, please make sure they have our correct address so your payment is sent to the correct place.

Also, remember the following information:

- As your facilitator, we cannot offer any interest rate reductions or incentives for automatic payments set up through third parties. You may want to sign up for protection, our automatic payment program; your lender may offer incentives.

- Please enter your AES account number completely and accurately into your bill payer or standard website to ensure timely application to your account.

- If your bill payment service mails payment to us, it will be effective the day we receive payment, or the next business day if it is a weekend or holiday. If you have questions about whether a third-party service mails us a payment, you should contact them for details.

- Your bill payer may not answer any additional instructions or text when submitting your payment, such as in the “Memo” text. If you have specific instructions on how we should make payments using our suggested online payment methods, or if you would like to set up standing payment instructions for future underpayments or overpayments, you can do so by logging into your account.

Set up prepayment

- With account access and phone calls, you can arrange future payments. Each month, you can schedule up to eight payments within the next 180 days. You have the flexibility to set up payments when you know you have funds available.

- The option to set up a prepayment can be especially useful if you want to make multiple payments in a given month, or if you want to check your loan less frequently.

AES student loan Customer Service contact information

Toll-Free Number: (800) 233-0557

Call Customer care line:

- Default Collections (Fax): (717) 720-3644

- International: (717) 720-3400

- US/ Canada: (800) 233-0751

Mail address:

Send Payments Express/Overnight Deliveries to:

American Education Services

Box #65093

1800 Washington Blvd., 8th Floor

Baltimore, MD 21230

Send Express/Overnight Letters and Correspondence Deliveries to:

American Education Services

1200 North 7th St.

Harrisburg, PA 17102

Social Media Platform:

FAQs

We appreciate you reading this article. Seattleducation really hopes you enjoy and learn from it. Please leave your comments below to further the conversation and provide more support and information.