Alberta Student Loan Login, Repayment & Alberta Student Aid

If you are looking for a place to borrow money to pay tuition or cover school expenses, you must first know what you are applying for. Different types of loans will have attractive loan renewal packages and all offer different rewards, perks and benefits, etc; some are much better than others.

Take for example Alberta student loan – a safe place for both parents and students to borrow money, where you can feel secure working with them for a long time.

Alberta Student Loan login instructions will help you understand what makes it become unique from other loan services, how to use it to your advantage, how debt is calculated, what is the interest rate, and the different ways you can pay with it in the future.

Related content:

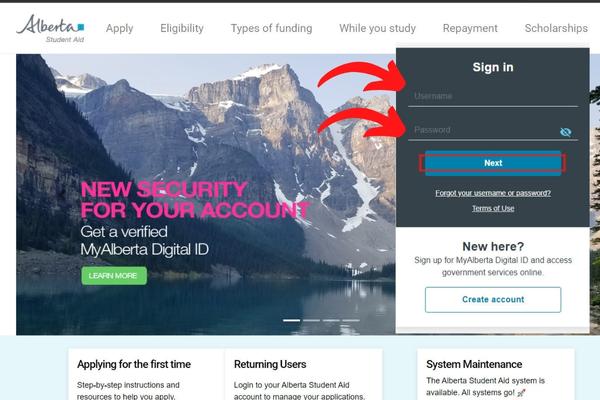

Alberta Student Aid Login Online By Website

Alberta Student Aid provides student loans, grants, scholarships and awards for Albertans pursuing full-time or part-time post-secondary education.

Here is the step-by-step guide for Alberta loan account Login:

- Visit Alberta’s official website with link: https://studentaid.alberta.ca

- Enter your username and password in the given blanks

- Choose “Next” to complete the sign in process

Alberta Student Customer Service Centre

If you have any difficulties or problems related to your account, loan costs, interest rates, payment terms,… or would like to know more about the new student award programs you have available. can be contacted as below:

| Monday through Friday 7:30 a.m. to 8:30 p.m. Alberta time (MST) | Dial Toll-Free outside of North America Dial the international access code + 800-2-529-9242 |

| Dial Toll-Free in North America 1-855-606-2096 | TTY for the Hearing Impaired 1-855-306-2240 |

| Mailing Address Alberta Student Aid Box 28000 Station Main Edmonton, Alberta T5J 4R4 | Courier Address (no public access) Alberta Student Aid 11th Floor, 10155-102 Street Edmonton, Alberta T5J 4G8 |

Apply for student Alberta loan account

You must be at least 18 years old to perform enrolment and request that payment fee learn. It will require identification (such as a driver’s license). To get this, your best bet is to research what you can do to improve your credit before applying for a card. Here are the steps:

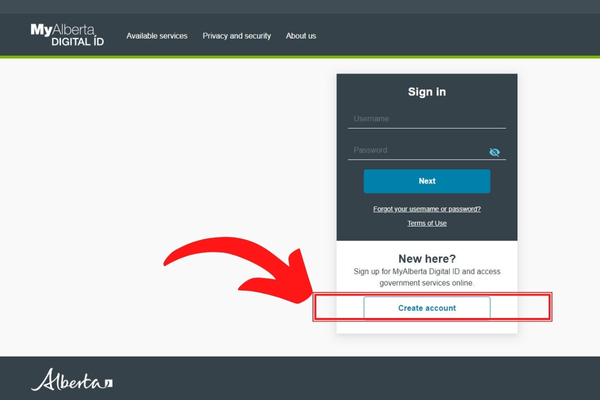

Step 1. Go to Alberta registration page

You should access the new account registration area when selecting “Create account“.

Step 2. Fill the Information

After being redirected to the new page, please fill out the online registration form including the required data such as:

- Username

- Confirm Email

- Password

- Confirm Password

- First Name

- Middle Name(s) (optional)

- Last Name

- DOB (Date of Birth)

- Sex

- Country

- Province

- City

- Address Line

- Postal Code

- Telephone (optional)

- Cell Phone (optional)

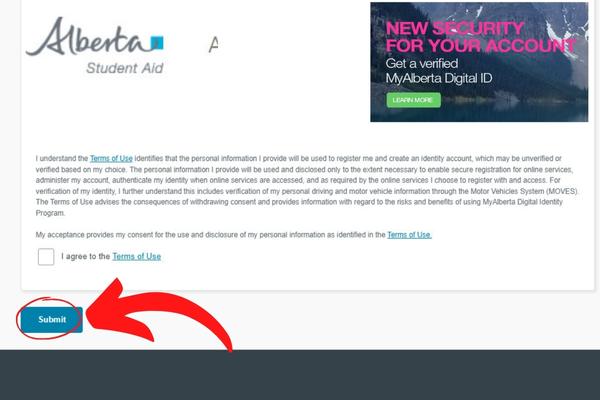

Step 3. Follow the instructions

Complete your Alberta account registration process by following the prompts. The account will be successfully registered after four steps and a few operations guided specifically by the system.

Note: In case all else fails, contacting customer service may be able to help you improve your credit fast enough for you to proceed with the card application.

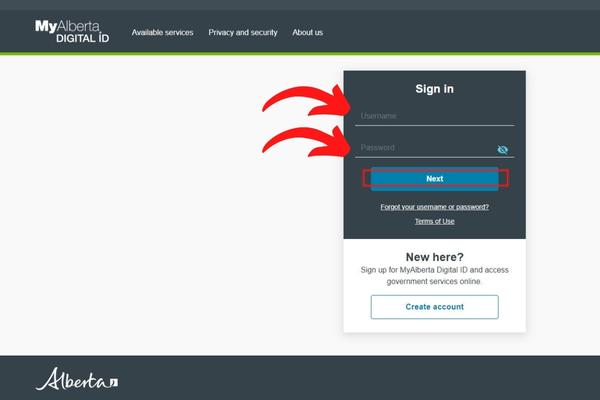

How to retrieve the account name and login password for MyAlberta Digital account?

Having trouble logging in related to account ownership information? No problem. Check out the steps below and follow the instructions exactly to get it back.

- In the account login box, select the words “Forgot your username or password?“

- Tick the box “I’m not a Robot” – it is a security device to prevent automated use of this service

- Press on “Recover Username” or “Recover Password” and wait for the system to send you a new one.

Alberta student loan repayment

Your Canada and Alberta student loans will be paid and interest-free for six months when you graduate or cease to be a full-time student. For details on other provinces/territories, please contact your province/territory of residence.

The repayment period for Canada and Alberta loans will begin on the first day of the 7th month after you cease to be a full-time course load (i.e. if you graduate in April, your student loan will be paid in October and start repayment). If needed, you have to make sure that you start to apply for funding before the eligibility repayment period begins.

If you have both Canada and Alberta’s loans, you will need to make two payments: one to Alberta Student Aid and one to the National Student Loan Servicing Centre (NSLSC). Keep an eye on your student loan portal for important information in the months leading up to your repayment date.

If you are a full-time student, your loan will not go into a request that payment is sent to full-time enrolment and request as long as you notify Alberta/Canada Student that you are a full-time student. You can let them know you are a full-time student by taking out a new full-time loan or completing the online application for interest-free status (you only need to complete one of these options, not both).

Alberta student loan forgiveness COVID

The government of Alberta will forgive student loans for residents affected by COVID-19. For many who are struggling to make ends meet during these difficult times, this has been a welcome relief. The program forward will be for people who have lost their jobs or have had their hours reduced due to the pandemic.

This is seen as a much-needed measure that could help many Albertans get back on their feet. This makes the Federation of Canadian Students (CFS) happy to see the government taking this important step and thank them.

Government Student Loan Program

There are two options for government student loan apprenticeships: the Canada Student Loan Program (CSLP) and the Canada Student Grant Program (CSGP).

CSLP can provide loans to students to cover 60% of tuition payment deadline. To be eligible for this loan, you must be a permanent resident of the province that issued the grant or loan. You must also be enrolled in a degree program within 12 of the 15 weeks.

CSGP gives students money that they don’t need to pay back. Requirements to receive these bursaries are more stringent, meaning students must demonstrate serious financial need. There are other categories of students with disabilities.

FAQs

Need more help with Seattleduation? Email us, connect with us on social media, or leave a comment. Don’t forget to visit our website frequently to read and learn more about digital banking.