Find Outstanding Student Loans Balance | Federal Student Aid

Find outstanding student loans with repayment process quickly and easily: make payments, change repayment plans, explore options, and get help to delete debts, extend debts…

How to find your Federal Student oan balance

Using the National Student Loan Data System

To find your current federal student loan balance, you can use the National Student Loan Data System (NSLDS), a database run by the Department of Education.

When you enroll in a college or university, the school administration sends your loan information to NSLDS. The database also pulls information from loan servicers and government agencies, so it’s a comprehensive overview of all FSA you’ve received.

- Create an account with your Federal Student Aid ID and log in

- Track of your student loan in your name, including original amount, current balance, interest rate, monthly payment status, and loan servicer

- Visit your multiple loans website to create an account, make payments online and ask any questions you may have

While NSLDS is useful, there are some limitations:

Not always up-to-date: To look up your account information on NSLDS can be up to 120 days old, so it may not be an up-to-date view of your loan.

Not all loans are listed: NSLDS only contains information about Title-IV eligible loans and grants, so if you take out another borrower — such as loans for medical or nursing school programs—they won’t appear on NSLDS superior. Pay off finding your student loan refinance are also not listed.

Contact your school’s financial aid office

If you have federal loans that do not appear on NSLDS, another option is to contact your school’s financial aid office. The staff there can look up your past loan information, including what you borrowed initially and who the loan servicer was. With this information, you can contact the servicer to get your current loans.

How to Find Your Private Student Loan Balance

Because NSLDS only applies to federal loans, your private student loans will not appear in the database. These also don’t appear if you refinance any federal loans, because once you refinance your student loan debt, they become plans that works could end up owing loan changed.

To find any private student fee balances (or check who your lender is):

- Get your credit report from three national database agencies – Experian, Equifax and TransUnion – at AnnualCreditReport.com (you can do it for free once a year)

- Check your minimum amount due every month for a list of all your current obligations, including student loans. It will list how much you have borrowed and who the federal director is.

- Contact a loan servicer to begin making repay or begin the student loan refinancing process

Where can I find my loan information?

An important factor in keeping up with private student loan payments is knowing where to find all student loan information. StudentAid.gov is the U.S. Department of Education’s comprehensive database of private and federal student loans. This is your one-stop shop for all your federal student loan information.

Advantages:

- Your calculator student loan amount and balance

- Your loan servicer and its contact information

- your interest rate

- Your current loan status (repayments, defaults, etc.)

How to started:

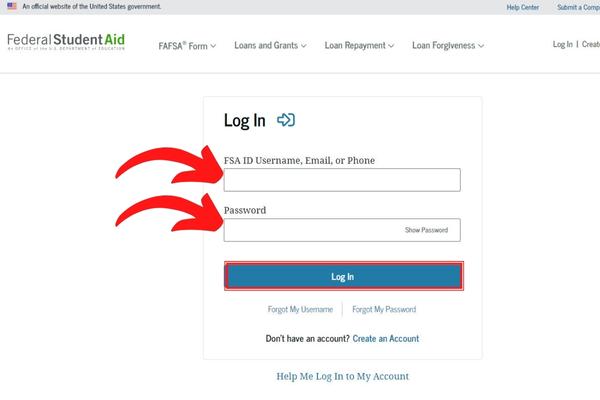

- Go to StudentAid.gov

- Click to “Log In“

- Have your FSA ID ready. This is the same username and password you used to electronically sign the FAFSA. To learn more about FSA IDs, visit studentaid.gov.

- If prompted, enter your name, social security number, date of birth, and FSA ID.

- Read the Privacy Statement. You must accept these terms to use StudentAid.gov.

- Select “ Log In“

Note: StudentAid.gov can be an invaluable tool for you to track your student loan information. Checking StudentAid.gov and speaking with your loan servicer will give you the information you need to get back on track with your student loan repayments.

Read more: Vystar Credit Union Login Online Banking And Mobile App

Learning how much you owe in student loans balance

It’s very likely that the tuition you borrowed initially is not know how much you owe now – unfortunately, you may owe more.

Unless you have federally subsidized loans or make on-campus payments , managing your refinance student loans will grow over the years you spend in school due to interest. Depending on your interest rate, you could graduate with hundreds or even thousands of dollars more than you originally borrowed.

For federal student loans

Figuring out how much you owe on federal loans is fairly straightforward. The Federal Aid website, administered by the Department of Education, brings together all of your federal student find out your loan in one place.

To access your account, you need a Federal Student Aid ID => Once logged in, you can view the original loan amount, new loan, interest, and payment status on the Dashboard.

Keep in mind that servicers sometimes transfer student loans to other companies. Fortunately, your studentaid.gov account will show if your loan servicer has changed. Once you have identified your current loan provider, it is best to contact them directly for the latest details on your loan.

The National Student Loan Data System (NSCDS) used to be the primary private of federal student loan information. But as of 2020, your studentaid.gov account and loan servicer are now the most effective resources for checking DOE conditions.

For private student loans

Retrieving the balance of a private loan is a bit more complicated than a federal loan. While you decide to pay for school with Experian and Transunion history dashboard for federal loans, there is no state website for private student loans.

Additionally, the financial institution that originally issued the loan may outsource loan servicing elsewhere or even sell your loan to a different entity.

However, here are some ways to find out how much private loan balance:

- If your loan changed servicers, ask your original lender: your original lender is always the best place to start this search (hopefully you’ve saved your original loan documents with the lender’s contact information). A phone call should help you find your current student product and current servicer.

- Ask your school for help: If you’re having trouble tracking down your loan, check with your college’s financial aid office. They can help you determine who is currently managing your debt.

- Check you’re otherwise endorsed: A credit card report lists your current and past insurance obligations, including student loans. Here, you’ll see the amount you borrowed and the loan servicer, which you can then contact to find out your account status or payment.

- You can get free credit reports from the three major credit reporting agencies – Experian, TransUnion and Equifax by visiting AnnualCreditReport.com.

5 Ways to Pay Off Your Student Loans Faster

Once you figure out how to check your federal and private student loans, you can develop a strategy to pay them off. Depending on your financial situation, you can speed up your repayments and save money by doing one or more of the following:

- Pay off debt with a windfall: Even if you’re on a tight budget, you can use any windfall to pay off your loan faster. If you receive a raise, bonus, tax refund or even just a birthday check, use the money to pay off your life of the loan in one lump sum. Additional payments can add up and help eliminate your loan early.

- Pack a side business: For those who need more breathing room in their budget, starting a side business can be a great way to earn extra cash to pay down debt in your spare time.

- Check with your employer for loan assistance: Some employers offer student loan repayment assistance as part of their benefits program. Ask your human resources department if your company has such a apr privilege.

- Set up: Setting up automatic payments can help prevent missed payments and reduce the interest you pay. Some lenders even offer a 0.25% discount on your interest rate when you sign up for automatic payments.

- Consider refinancing: If you have a high-interest loan, refinancing your student debt may help lower interest rates and save money. This can be a particularly good move if you have private mortgage refinance. On the other hand, if you refinance federal debt, you’ll lose certain loan benefits — so unless these federal loans have relatively high-interest rates, it’s usually not worth it.

FAQs

Thank you for reading the article on the Seattleducation website, please leave comments to help us develop more. Thank you!