Psecu Member Login Online Banking, Loans, Quick Pay

PSECU login is one of the most convenient services for card holders to view and check their banking statements. This is also a simple way to manage online accounts. In this article we guide you how to login, recover password and some necessary information.

Overview About Psecu

The Pennsylvania State Employees Credit Union (PSECU) provides excellent cooperative banking services to its members. Now it has spiced it up with convenient online banking services on their business.

The PSECU, meanwhile, has begun rolling out Cyota’s two-factor authentication technology, which analyzes the potential risk of each online banking transaction based on criteria such as the user’s computer, IP address, geographic location, and previous transaction behavior.

Users conducting online banking transactions flagged as high-risk by the system are authenticated over the phone.

If you already have an account that you want to log into, or you’re new and want to log in, follow these steps to log in, reset your password, and sign up for online banking. First, watch this video to have an overview of Psecu platform.

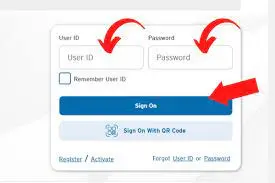

Psecu Login

- Go to the Pennsylvania State Employees Credit Union home page

- Click on the login link on the homepage as shown below.

- A pop-up window will appear and you need to enter your password and then click on the “Sign In” button

- Once you click the login button, you will be redirected to your online banking dashboard.

Remember that the password is case-sensitive. So make sure you use the correct capitalization.

Forgot Password?

Sometimes you might forget your password. The good news is that you can easily reset your password with the following steps:

- Click on the Login Help link on the login page as shown below

- Enter your user name or Account number and PIN

- Click “Next”

Once you have submitted the details, a new password will be sent to your email address.

Register For Psecu Online Banking

PSECU enables its customers to register for PSECU online banking. All you need is either an active checking account or a savings account. To register for online banking, proceed as follows:

- Visit the site: psecu.com

- Click on the “Sign Up for Online Banking” link just below the sign in area on the left menu

- On the next page, fill in the blanks and click Next

- Create your login ID and password and confirm it.

Psecu Mobile Banking Login

- Enhanced for tablets and mobile devices – Log into your online banking acc from your desktop, mobile or tablet and easily manage your activity.

- Manage Cards – Block or unblock your cards, manage card and deposit limits, manage rewards or perform a Visa balance transfer.

- Bill Payer – Save time and money. Pay bills directly from your check stock right from the palm of your hand.

- Transfer money – Go cashless. Transfer money to your personal or an external acc. Pay friends and family with our member-to-member transfer.

- Psecu mobile deposit (available in our mobile app only)

Take a picture of your checks to direct deposit them.

Download PSECU app on Google Play

Download PSECU app on App Store

After Login: Manage Your Psecu Online Banking Account

PSECU offers its customers the confidence of online banking. There are many things you can do, including the following:

- You can see your account balance

- You may receive eStatements of your account

- You can set up notifications for account activity

- You can transfer funds between accounts in PSECU

- Update or change your password and personal information

- Pay bills

Psecu Debit Card

PSECU, Pennsylvania’s largest credit union, recently launched a new debit card rewards program in which members can earn $0.05 or $0.10 for eligible PSECU debit card purchases of $10 or more.

Debit card rewards, which debuted as part of the credit union’s record-breaking $22 million 2018 Special Membership Reward (like free credit score service), became a PSECU Money Back Banking benefit on January 1, 2019.

The Benefits Of Psecu Login

The Best

Members of PSECU include government employees, faculty, staff, students and graduates of the universities that make up the Pennsylvania State System of Higher Education, Harrisburg PA Area Community College, Penn State faculty and staff, local government employees and individuals who eligible Join the Pennsylvania Public School Employees Retirement System or the State Employees Retirement System, select school districts, members of authorized associations, and employee/professional groups.

Easy Account Access

PSECU is a credit union that prioritizes giving its members access wherever it’s most convenient for them. Whether on their phone, in the garden or in the living room.

They have well-designed, highly rated apps available for Apple and Android smartphones. Thanks to the technology, PSECU can give its members 24/7 access via PCs or the telephone.

Access to the PSECU home online account is used by many members. With this handy service, they can pay their bills, deposit money into various accounts or repay loans, check (and print) check photos, and receive notifications about account activity.

Savings Accounts

PSECU offers hassle-free, no-fee dividend income verification for its members, who must be at least 12 years of age. PSECU also offers savings and certificates of deposit.

Basic checks with unlimited check issuance, free online statements and check images, free online account access, bill payment services, and credit evaluation services are all benefits of their free verification.

There is no minimum balance to earn interest and the dividend is not subject to any additional requirements or monthly service fees. The APY on their checking accounts is 0.10 percent.

Payment Slips

PSECU members can safely and conveniently invest their funds in Certificates of Deposit. PSECU offers a range of certificate periods and prices.

PSECU bank offers terms from three to sixty months and requires a minimum balance of $500 to open accounts and qualify for dividends. There are no monthly service fees for their certificates. Rates are declared weekly and are set for the life of the certificate when a member creates one.

The Drawbacks Of Psecu Log-In

The Poor

There’s nothing particularly terrible about the Pennsylvania State Employee Credit Union. They don’t appear to charge any notional monthly account maintenance fees, and they don’t force you to use their products to reduce those costs.

Fees

There weren’t many charges, but PSECU’s $5 quarterly fee for paper statements was one of them. A fee will be charged for inactive accounts. PSECU charges an account a monthly fee of $2 if it has not been used for at least a year but is still open. Members can contact PSECU or make a deposit/withdrawal to avoid the cost.

The final cost is for changing your address. If you move and do not notify PSECU of your new address for the entire previous calendar year, a $10 service fee will be charged.

Few Credit Card Options Available

There is now only one credit card option available through PSECU and it has a low fixed price. They receive no additional benefits for using their card.

Fewer Locations

Last but not least, PSECU only has three walk-through locations. Their guiding principle is that by dispensing with branch costs, they can offer their members attractive interest rates on loans and savings accounts, as well as a wide range of cheap or free services.

In the long run, this could benefit their members, but it could be a challenge for people who don’t use computers or mobile apps to bank with them. Additionally, many branch credit unions in the 1950s offered slightly higher interest rates than other credit unions.

Psecu Login For Auto Loans

Conditions And Annual Percentage Rate

- Car loans for new and old vehicles: APR from 2.49 percent to 8.74 percent and higher for terms from one month to 120 months.

- Auto loans refinancing rates start at 2.49 percent to 8.74 percent and higher for terms from one month to 120 months

- Lease buyout loans with introductory APRs from 2.49 percent to 8.74 percent and higher for terms from 1 month to 120 months

- All APRs include a 0.25 percent rebate for autopay, so keep that in mind. Depending on the length of your loans.

Term Loans

Brand New Vehicle Loans: PSECU finances up to 100% of the Manufacturer’s Recommended Retail Price (MSRP).

Used Vehicle Loans: PSECU lends money for vehicles up to their retail value if they are valued at least $3,000.

Retail value is based on Kelley Blue Book value or other recognized price source.

The car must be worth at least $40,000 and you must have at least $40,000 in financing to qualify for a 120-month term on any of the PSECU loans. There are minimums, but no additional minimum loan amounts.

Loan Requirements

Loan Membership Criteria

- Remember, you must be a member to be eligible for PSECU auto loans.

- You must work for: State or local government School District Municipality

In addition, you can join if you: join PSECU by working for a company that does.

What Other Loan Types Does PSECU Offer?

These are the different loan types that PSECU offers:-

- car loans.

- individual loan

- debt consolidation.

- Commercial Loans.

- equity in a house

- Mortgage.

- Loans for students.

Federal Holiday Plan For 2022 & 2023

These are the federal holidays when the Federal Reserve Bank is closed.

The Pennsylvania State Employees Credit Union (PSECU) and other financial institutions are closed on the same holidays.

| Holiday | 2022 | 2023 |

| New Year’s Day | December 31 | January 2 |

| Martin Luther King Day | January 17 | January 16 |

| Presidents Day | February 21 | February 20 |

| Memorial Day | May 30 | May 29 |

| Juneteenth Independence Day | June 20 | June 19 |

| Independence Day | July 4 | July 4 |

| Labor Day | September 5 | September 4 |

| Columbus Day | October 10 | October 9 |

| Veterans Day | November 11 | November 10 |

| Thanksgiving Day | November 24 | November 23 |

| Christmas Day | December 26 | December 25 |